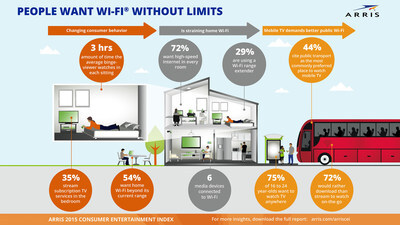

Worldwide, the average home now has six media devices connected to its Wi-Fi network, and the average household spends almost 6.5 hours each week streaming a subscription service. Moreover, four out of five (81 percent) of those who stream now do so at least weekly, up from 72 percent just last year. There is a clear connection between Wi-Fi and mobile TV too, with nearly three-quarters (73 percent) of people who watch mobile TV at least once a week, using Wi-Fi to do so.

These trends are a likely culprit of the Internet issues that nearly two-thirds (63 percent) of global consumers experience, as well as their renewed interest in high-speed Internet in every room of the house – a service that 72 percent indicated was either very important or vitally important.

The research underscores new qualifications for the rise of both mobile TV and binge-viewing. While the popularity of mobile TV continues to increase—more than half (59 percent) of consumers are now watching TV on-the-go—the potential for growth is greatest in older demographics, where barriers of inconvenience and cost continue to challenge broader market adoption. Meanwhile, binge-viewing has evolved into a very personal and solitary activity for 60 percent of binge-viewing consumers.

The good news for service providers is that these trends represent a number of opportunities to make it easier for consumers of all ages to download or stream content, to customize content and services to the individual consumer experience, and to solve connectivity issues by giving consumers a high-speed wireless connection where it is needed—all over the home—through better Wi-Fi equipment and training.

Key findings from the 2015

- Good quality Wi-Fi has become a necessity in homes: 72 percent of consumers consider a high-speed Internet connection in every room of their house either vitally important or very important. And, more than half (54 percent) state that it is vitally important to have high-speed Wi-Fi that works outside of its current range. Service providers have a tremendous opportunity to solve connectivity issues for consumers by providing reliable, high-speed connections throughout the home.

- Popularity of mobile TV is maturing among younger demographics, but future growth will rely on older generations: More than half (59 percent) of all people now watch mobile TV, rising to 72 percent of 16-24 year-olds. However, while young people watch the most mobile TV, there has been no increase in the number of viewers. For 65+ year-old consumers, the number of mobile TV viewers has increased by a remarkable 11 percent, up from 19 percent last year. This demographic presents an excellent growth opportunity for operators if they can help consumers overcome barriers of inconvenience and cost, and make it easier to download or stream content.

- Consumers prefer to download vs. stream mobile content: Nearly three-quarters (72 percent) of downloading consumers say it is important to be able to download content to a device so they can watch it on-the-go without an Internet connection, rather than having to rely on cellular connections to stream. Also, 73 percent of the respondents who watch mobile TV use Wi-Fi to do so. This presents an opportunity for service providers to facilitate content downloads to mobile devices.

- Binge-viewing has gone solo in 2015: 60 percent of binge-viewers do so alone, and the average binge-viewing consumer now watches for three hours in each sitting. Thus, service providers have an opportunity to personalize content and services for the individual and deliver a more tailored customer experience.

- Slow Growth in OTT Fails to Draw Broadcast TV Users: The past year has seen a nominal increase in OTT users (from 93 percent to 94 percent) and a similarly nominal decrease in broadcast TV users (from 97 percent to 96 percent). This highlights a disparity between industry expectation of these services and their actual rate of acceleration and suggests that Broadcast TV remains king for now.

"All of these trends point to a tremendous opportunity for service providers and programmers to customize their offerings to these new consumer trends and to ensure the quality of the home's Wi-Fi network, which increasingly is bearing the weight of this evolution in services."

Reliable Wi-Fi evolves from a convenience to a necessity in every room

Reliable Wi-Fi has become a necessity in homes as the average global household now has an average of six media devices connected to its Wi-Fi network. However, two-thirds (63 percent) of consumers have experienced significant issues around slow Internet speeds that affect streaming and downloading of large files and video. Service providers have an opportunity to solve connectivity issues by giving consumers a high-speed wireless connection where it is needed – all over the home.

- 72 percent of consumers say having a high-speed Internet connection available to use in every room of their house is either vitally important or very important.

- On average, 54 percent of respondents say it is vital to have high-speed Wi-Fi that works beyond its current range, it is even higher in some countries, most notably in

Asia-Pacific :South Korea (68 percent)China (67 percent)India (61 percent)

- Issues with streaming and downloading content varies by country:

- Four out of five (80 percent) of Chinese Internet users experience issues – the highest reported

- A third (38 percent) of Japanese Internet users experience issues – the lowest reported

- Respondents are disappointed with Wi-Fi quality in multiple rooms in the house:

- Living room: 13 percent

- Master bedroom: 13 percent

- Kitchen: 10 percent

- Toilet and bathroom: 10 percent

- While on average, 29 percent of global respondents use a Wi-Fi range extender, it is even higher in some countries:

- More than half of people in

India (52 percent) use a Wi-Fi range extender - 47 percent in

Brazil - 42 percent in

Russia

- More than half of people in

- And while on average 19 percent of global respondents are considering getting a Wi-Fi range extender, again, this trend is even higher in some countries:

- 32 percent in

Mexico - 29 percent in

Turkey

- 32 percent in

- The bedroom has become even more popular as a place to stream TV and movies:

- 35 percent of those who stream a subscription service do so in the bedroom (up from 22 percent in 2014)

- Of course, not everyone even has or uses Wi-Fi at home:

- 9 percent of global respondents do not have or use Wi-Fi at home

- 17 percent in

Russia do not have or use Wi-Fi at home - 28 percent in

Japan do not have or use Wi-Fi at home

Popularity of mobile TV is maturing among younger demographics, but future growth will rely on older generations

The popularity of mobile TV is maturing among younger demographics, 59 percent now watch TV on the go. However, future growth will rely on older generations. The industry must help consumers overcome barriers of inconvenience and cost, and make it easier for consumers to download or stream content.

- This year, consumers are 7 percent more likely to watch mobile TV away from home, and 6 percent more people watch TV in that manner every day

- Most surprisingly, in 2015 mobile TV grew the most among 65 year olds and over (11 percent increase)

- However, the younger people are, the more they watch mobile TV:

- 72 percent of 16-24 year-olds watch mobile TV

- 53 percent of 45-54 year-olds watch mobile TV

- 42 percent of 55-64 year-olds watch mobile TV

- Mobile TV consumption varies by age group, for 25-34 year-olds, specifically:

- One in five (21 percent) watch mobile TV daily

- More than half (57 percent) watch mobile TV at least once a week (up from 53 percent in 2014)

- Although, 27 percent never watch mobile TV (down from 29 percent in 2014)

- Not everyone wants their TV to be mobile:

- 41 percent of global respondents never or rarely use a laptop, smartphone or tablet to watch TV outside the house

- This rises to three-quarters (75 percent) of respondents in

Japan , followed by 62 percent inAustralia , and 60 percent inCanada

- High costs are holding back younger people from watching mobile TV. For older people, the screen is the main reason

- The majority of mobile TV consumers use Wi-Fi:

- 73 percent use free Wi-Fi

- 50 percent use 3G/4G/5G

Consumers prefer to download rather than stream mobile content because of patchy coverage while on-the-go

The majority of respondents prefer to download vs. stream content for mobile viewing. 72 percent of downloading consumers say it is important to be able to download content to a device so they can watch it on-the-go without an Internet connection, rather than having to rely on cellular connections to stream.

- Consumers mostly prefer to watch mobile TV while travelling:

- 44 percent watch on public transport (highest in

South Korea at 68 percent andSingapore at 67 percent) - 41 percent while waiting to meet someone (highest in

Brazil at 54 percent) - 31 percent watch in the car (highest in

India at 52 percent and in the US at 44 percent) - 31 percent while waiting to receive a service such as at the doctor's or a repair shop (highest in

Brazil at 46 percent) - 30 percent at restaurants, cafes, bars or pubs

- 27 percent while out walking

- 24 percent at a hotel

- 14 percent while shopping

- 44 percent watch on public transport (highest in

- 68 percent of respondents said they are interested in a service that allows them to watch any TV program at any location

- Rising to 75 percent for 16-24 year-olds

Binge-viewing is a solo activity

Expanding on binge-viewing trends uncovered last year, binge-viewing has gone solo in 2015 – service providers have an opportunity to personalize content and services to the individual for more tailored customer experiences

- 60 percent of binge-viewers in 2015 said they do so alone

- Solo-binging is most popular in the

Asia-Pacific region :- Four out of five (80 percent) of binge-viewers solo-binge in

Japan - 77 percent in

China - 72 percent in South Korea

- Four out of five (80 percent) of binge-viewers solo-binge in

- And is lowest in

Latin America :Mexico solo-binges the least with only 40 percent of binge-viewers doing so

- More young people binge-view, and they do it for longer:

- 89 percent of 16-24 year-olds binge-watch globally

- On average, they watch for 4 hours each time

- 70 percent of 16-24 year olds binge-view at least once a month (the same as last year)

- People prefer to binge-watch on a TV, but mobile-binging is also rising:

- 69 percent binge-viewers use a TV (up from 61 percent in 2014)

- 21 percent use a mobile device (up from 16 percent in 2014)

- Binge-watching is a monthly occurrence for most people:

- 33 percent of all respondents binge-view at least once a week

- 56 percent binge-view at least once a month

- 54 percent of people in

Brazil binge-watch weekly though (up from 39 percent last year)

Slow Growth in OTT Fails to Draw Broadcast TV Users

Note that numbers in italics have been updated

Results reveal disparity between industry expectation of OTT/catch-up TV services and its actual rate of growth and suggests that Broadcast TV remains king for now.

- 1 percent growth in OTT users since last year (from 91 percent to 92 percent)

- Rising to 12 percent in the 65+ year-old age group (from 70 percent to 82 percent)

- 1 percent drop in broadcast TV users who have access to OTT (from 96 percent to 95 percent)

- The average consumer spends 10.7 hours per week watching free broadcast TV

- Compared to:

- Subscription paid TV: 10.2 hours/week

- Internet stream via on-demand TV service or catch-up TV service: 6.4 hours/week

- Internet TV with / without attached box: 6.6 hours/week

- Internet stream via paid subscription TV service: 6.4 hours/week

- Compared to:

About The ARRIS Consumer Entertainment Index

ARRIS's Consumer Entertainment Index is a research project looking into the media consumption habits of 19,000 consumers across 19 markets:

This research is focused on media content consumption on multiple devices. The aim of the study was to develop both a global and regional understanding of what content was coming into homes and how it was being consumed, how viewing habits are evolving, and trends service providers should seek to support both now and in the future. The research is statistically representative of all connected consumers in the world.

To access the report, go to: www.arris.com/arriscei

About ARRIS

For the latest ARRIS news:

- Check out our blog: ARRIS EVERYWHERE

- Follow us on Twitter: @ARRIS

ARRIS and the ARRIS Logo are trademarks or registered trademarks of ARRIS Enterprises, Inc. All other trademarks are the property of their respective owners. © ARRIS Enterprises, Inc. 2015. All rights reserved.

Photo - http://photos.prnewswire.com/prnh/20150721/238982-INFO

To view the original version on PR Newswire, visit:http://www.prnewswire.com/news-releases/2015-arris-consumer-entertainment-index-reveals-disparity-between-expectation-and-reality-of-home-wi-fi-as-consumers-demand-wi-fi-without-limits-300116748.html

SOURCE

Jeanne Russo, +1-610-312-1172, jeanne.russo@arris.com or David Hulmes, +44 7834 575863, david.hulmes@arris.com